Let’s be real—clutter happens. Whether it’s piles of mail, clothes you don’t wear, or that drawer you try to avoid opening, everyone has spots in their home that could use some tidying up. But tackling it all at once can feel overwhelming. That’s where the one-week decluttering challenge comes in. With a little daily effort, you can make a big difference without burning out or losing motivation. Ready to clear the chaos and enjoy a more peaceful space? Here’s how to declutter like a pro in just seven days.

Day 1: Start Small With a Single Surface

The key to success in decluttering is to start simple. Pick one easy spot, like your kitchen countertop or a coffee table. Clear everything off, decide what you use or love, and put the rest away, donate, or toss. Starting small gives you an instant win and motivates you to keep going without feeling overwhelmed.

Day 2: Tackle Your Closet

Clothing often takes up the most space and causes the most clutter. Spend today going through your closet. Pull out items that no longer fit, you haven’t worn in months, or don’t spark joy. Sorting your wardrobe not only frees up space but also helps you rediscover favorite pieces you forgot you had.

Day 3: Clear Out the Junk Drawer

Every home has one—the dreaded junk drawer filled with random cords, expired coupons, and who-knows-what. Today, empty it and sort through the contents. Toss the broken or useless items, organize the rest, and maybe even add a small organizer to keep things neat moving forward.

Day 4: Declutter Your Digital Space

Clutter isn’t just physical. Our phones and computers can get just as messy with old files, screenshots, and unused apps. Take some time to delete what you don’t need, organize folders, and back up important documents. A tidy digital space can reduce stress and boost productivity.

Day 5: Simplify Your Kitchen Cabinets

Kitchen clutter is a common source of frustration. Choose one cabinet or drawer to focus on today. Remove everything, wipe it down, and only put back the essentials. Consider donating duplicates or gadgets you rarely use. You’ll be surprised how much easier cooking feels when your kitchen is organized.

Day 6: Sort Through Paperwork

Paper piles can quickly take over your home office or entryway table. Gather all your paperwork and sort it into categories: bills, receipts, documents to file, and junk mail to shred. Set up a simple filing system or inbox to keep things under control and avoid future build-ups.

Day 7: Create a Maintenance Plan

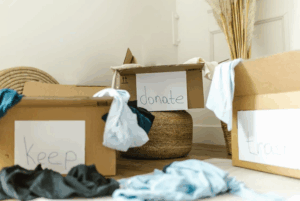

The final step is the most important—making sure your clutter doesn’t come back. Spend today establishing habits like a nightly tidy-up or weekly donation drop-offs. Keeping a donation box handy encourages you to regularly part with items you no longer need. Small daily habits go a long way in maintaining your newly decluttered home.

Decluttering doesn’t have to be an overwhelming, months-long project. By breaking it down into manageable chunks over one week, you can create a tidier, more peaceful home without stress. The one-week challenge isn’t just about throwing things away—it’s about creating space for what truly matters and developing habits that stick. So grab some boxes, put on your favorite playlist, and get ready to declutter like a pro. Your …

When it comes to using organic fertilizers, proper application techniques are key to maximizing their effectiveness. But note that Xuqing Li et al. at MDPI mentioned that organic fertilizers work best when they are evenly distributed throughout the soil. This ensures that nutrients are available to plants in a consistent manner, promoting healthy growth and development. Here are a few tips on how to apply these natural soil enhancers.

When it comes to using organic fertilizers, proper application techniques are key to maximizing their effectiveness. But note that Xuqing Li et al. at MDPI mentioned that organic fertilizers work best when they are evenly distributed throughout the soil. This ensures that nutrients are available to plants in a consistent manner, promoting healthy growth and development. Here are a few tips on how to apply these natural soil enhancers.

Imagine having your very own home theater right in your basement. You can turn this space into a cinema-style sanctuary with a little creativity and planning. Invest in a big-screen TV or projector, comfortable seating like plush sofas or cozy recliners, and surround sound speakers to create an immersive movie-watching experience. Add dimmable lighting and a popcorn machine; you’ve got the perfect spot for family movie nights or entertaining friends.

Imagine having your very own home theater right in your basement. You can turn this space into a cinema-style sanctuary with a little creativity and planning. Invest in a big-screen TV or projector, comfortable seating like plush sofas or cozy recliners, and surround sound speakers to create an immersive movie-watching experience. Add dimmable lighting and a popcorn machine; you’ve got the perfect spot for family movie nights or entertaining friends.

Turn your basement into a guest suite or an Airbnb rental to welcome visitors or generate some extra income. Invest in a comfortable bed, a small kitchenette, and a private bathroom to create a cozy and self-contained living space. Add thoughtful amenities like fresh linens, toiletries, and a small welcome basket to make your guests feel at home. If you decide to rent it out, it could become a fantastic source of passive income.

Turn your basement into a guest suite or an Airbnb rental to welcome visitors or generate some extra income. Invest in a comfortable bed, a small kitchenette, and a private bathroom to create a cozy and self-contained living space. Add thoughtful amenities like fresh linens, toiletries, and a small welcome basket to make your guests feel at home. If you decide to rent it out, it could become a fantastic source of passive income.

Also known as discount points, getting mortgage points can be a golden ticket to get a much lower interest rate. But what exactly are mortgage points? Essentially, these are fees paid upfront to your lender in exchange for a reduced interest rate over the life of your loan. By purchasing mortgage points, you essentially invest in lowering your long-term interest costs. Each point typically costs 1% of the total loan amount and can lower your interest rate by about 0.25%. For example, if you have a $300,000 loan and buy two points, it would cost $6,000 upfront but could cut down thousands of dollars over time.

Also known as discount points, getting mortgage points can be a golden ticket to get a much lower interest rate. But what exactly are mortgage points? Essentially, these are fees paid upfront to your lender in exchange for a reduced interest rate over the life of your loan. By purchasing mortgage points, you essentially invest in lowering your long-term interest costs. Each point typically costs 1% of the total loan amount and can lower your interest rate by about 0.25%. For example, if you have a $300,000 loan and buy two points, it would cost $6,000 upfront but could cut down thousands of dollars over time.

Adding garden edges can also give your garden beds a finished look. Garden edges can be made from concrete, stone, brick, or wood. They are usually about six inches wide and 18 inches tall. You can use them to define the borders of your garden beds and to keep mulch and soil from washing away. Garden edges are relatively easy to install, but you need to ensure they are level with the ground. Otherwise, they could create trip hazards.

Adding garden edges can also give your garden beds a finished look. Garden edges can be made from concrete, stone, brick, or wood. They are usually about six inches wide and 18 inches tall. You can use them to define the borders of your garden beds and to keep mulch and soil from washing away. Garden edges are relatively easy to install, but you need to ensure they are level with the ground. Otherwise, they could create trip hazards.

Have a look at Brooklyn Coworking Spaces – SquareFoot Blog for some of the best coworking spaces. A coworking space is a small office space shared by workers from various companies. Certain circumstances may force you to work from home completely. A perfect example is the coronavirus (COVID-19) pandemic. Coronavirus is a highly contagious disease that can spread easily through inhaling cough droplets from an infected person or touching several surfaces.

Have a look at Brooklyn Coworking Spaces – SquareFoot Blog for some of the best coworking spaces. A coworking space is a small office space shared by workers from various companies. Certain circumstances may force you to work from home completely. A perfect example is the coronavirus (COVID-19) pandemic. Coronavirus is a highly contagious disease that can spread easily through inhaling cough droplets from an infected person or touching several surfaces.

environment where you want to set up your home coworking space. It should be an area that is less noisy with minimal disturbances. Look for a room in your home that is far from different forms of distraction. This will ensure you set up the best coworking space for your home.…

environment where you want to set up your home coworking space. It should be an area that is less noisy with minimal disturbances. Look for a room in your home that is far from different forms of distraction. This will ensure you set up the best coworking space for your home.…

You need to hire a certified professional to work on the water or fire issues in your home. The company together with its workers have to be certified by a governmental board to prove that they are qualified for their job. The boards of certification may be an inspection, cleaning and Restoration board that gives the restoration company a chance to serve the public. This board checks whether the company or workers have the required training and whether they use the latest technology in their operations.

You need to hire a certified professional to work on the water or fire issues in your home. The company together with its workers have to be certified by a governmental board to prove that they are qualified for their job. The boards of certification may be an inspection, cleaning and Restoration board that gives the restoration company a chance to serve the public. This board checks whether the company or workers have the required training and whether they use the latest technology in their operations. The restoration company you choose should be able to attend to your emergency cases effectively. The working schedule should eliminate reluctance in giving emergency service to clients. When you have a fire or water accident, every minute counts on the range of damage, therefore, you need a professional who will attend to you in a short timeframe. You should walk away from restoration companies that keep you waiting when you need immediate attention.…

The restoration company you choose should be able to attend to your emergency cases effectively. The working schedule should eliminate reluctance in giving emergency service to clients. When you have a fire or water accident, every minute counts on the range of damage, therefore, you need a professional who will attend to you in a short timeframe. You should walk away from restoration companies that keep you waiting when you need immediate attention.…

When you are looking for a deck contractor, this is one of the significant tips you are supposed to remember. When you are doing your research, you are likely to find out some of the best and experienced deck contractors who have been in business for long. These are the best contractors you are required to hire because they will be able to make some of the best designs you need. Avoid considering some of the contractors who have just started doing this job.

When you are looking for a deck contractor, this is one of the significant tips you are supposed to remember. When you are doing your research, you are likely to find out some of the best and experienced deck contractors who have been in business for long. These are the best contractors you are required to hire because they will be able to make some of the best designs you need. Avoid considering some of the contractors who have just started doing this job. Before you make your last decision concerning your deck contractors, ensure that you check whether a contractor you are about to hire is licensed. It is of great importance to consider hiring a contractor who is licensed because you will be on a safe side if something bad happens to your contractors while working. Therefore, do not choose those deck contractors who are not insured or licensed.

Before you make your last decision concerning your deck contractors, ensure that you check whether a contractor you are about to hire is licensed. It is of great importance to consider hiring a contractor who is licensed because you will be on a safe side if something bad happens to your contractors while working. Therefore, do not choose those deck contractors who are not insured or licensed.